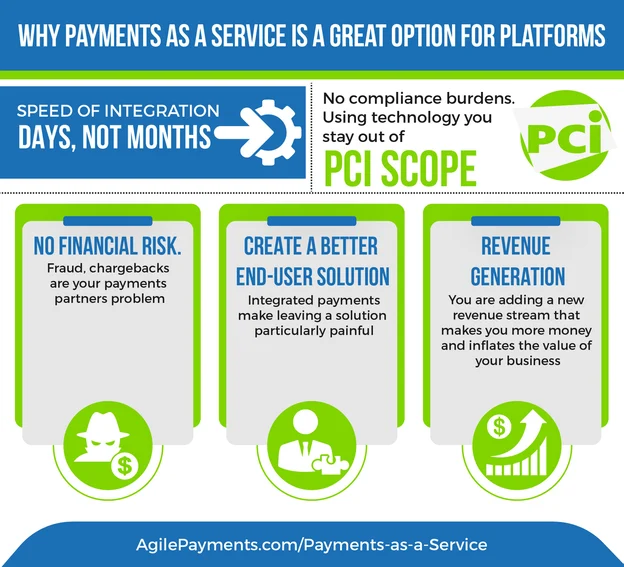

Here are reasons why Payments as a Service is such an attractive option for platforms

Payments as a Service, or PaaS, offers platforms and developers the ability to quickly and easily offer payment solutions, eg ACH and credit card, to the platform client base as well as revenue generation from payment processing fees.

Platform users can be instantly enrolled and begin collecting or disbursing customer payments.

Payments as a Service leverages powerful, elegant API’s that developers can easily test, deploy and go to market in a matter of days, rather than the many months typically required to integrate a payment solution.

We will address:

Payments as a Service is designed for SaaS platforms that are looking to add or expand payment solutions and in doing so create recurring revenue from payment related fees but don’t want to deal with compliance, financial risk, time consuming integration and certification demands.

PaaS lets platforms add and monetize payments very quickly while providing instant an onboarding experience for the end customer.

One example would be a daycare software provider that caters to smaller providers. The software manages check-in, scheduling, video display of the facility and more.

Clearly payment collection and reconciliation would be a welcome addition to their product and services option. Spending months or more integrating a payment solution only to have poor adoption because of cumbersome application processes make the idea of adding payments painful.

Using Payments as a Service the daycare developer could integrate, test and deploy in less than a week. The software users could apply for the payment solution and in 5 minutes be able to process parent payments.

The platform generates revenue on every payment processed.

Another example would be a field service app that helps painters/contractors run their business from their phone. Scheduling, estimates, customer communication are all important components of the app. But what is more important than being paid promptly?

Again the app developer could quickly and easily add a payment solution. Easy sign up for the painter is absolutely vital and you offer that as well. Not to mention every swipe of a card is another revenue stream.

How Payments as a Service works

In the Payments as a Service model your business is leveraging your payment partners Payment Facilitation tools.

A Payment Facilitation,eg Stripe, has the ability to instantly onboard merchants and assumes all compliance and risk factors.

Your platform essentially becomes a sub Payment Facilitation under your partner. You get to leverage all the technology, compliance and risk mitigation tools they have spent millions of $ on. In return you share in the payments revenue.

Revenue Potential Using Payments as a Service

Most platforms offering Payments as a Service or sub Payment Facilitation sell at 2.9% and 30 cents. It’s simple and well known. The costs to process payments vary depending primarily on the card type the customer is using.

Costs can vary from a low of around .2% and 22 cents using a regulated debit card, to a high of close to 3% when using a business card. At the time of sale you don’t know the cost but a reasonable estimate is 2.1%. In this case that leaves .8% of margin (there is margin in the 30 cents as well, likely around 25 cents).

As the platform your revenue share will depend on many factors but primarily processing $ volume. This percentage might vary from 25-65% or more.

We will use 40% as an example. So as the platform you see approximately .32% and 10 cents on every transaction.

If your average transaction $ amount is $100 and your platform generates a 1000 transactions per month in aggregate you see about $420/month in recurring revenue.

Here is a calculator you can use to compute potential revenue

We have seen platforms generate a few hundred dollars per month to those doing millions per year.

With how simple it is to add and monetize payments to your platform what are you waiting for?

Payments as a Service compared to Stripe

Here are a few areas of concern where Stripe is potentially not the best fit:

The biggest drawback is revenue generation

Is your client going to be happy with Stripe taking 3% and you taking something on top of that? Are you comfortable taking billing risk?

Is the best of both worlds possible?

Payments as a Service and Payment Facilitation

How Things Used To Work

In the past the HVAC operator would complete a fairly burdensome merchant account application, wait up to week or more to be approved, and then somehow enter their credentials into the SaaS application.

Traditional Payment Facilitation Solutions involved the platform going through an arduous application process. Think of a home mortgage for 20 million $ and then double the trouble. The purpose of this underwriting ordeal was to mitigate financial risk as the platform operating as the Payment Facilitator is funded the money from sub-merchant processing.

If there were instances of fraud or wrongdoing the Payment Facilitation platform provider bears the financial loss.

The time frame for Integrating to onboarding, the processing solution, risk mitigation, payouts etc, was minimally a 6-month process. Add to those issues mitigating ongoing risk and compliance burden costs and you can easily see why true Payment Facilitation is only for the big players.

In the last few years, payment providers have realized there’s a sizeable market for Payment Facilitator like solutions without all of the expense and hassle.

In the Payments as a Service model you are in essence a sub PayFac. So a true PayFac assumes all those compliance and regulatory and infrastructure costs. They have created a platform for you to leverage these tools and act as a sub Payment Facilitator. They have a lot of insight into your clients and their processing. This level of insight mitigates much of the financial risk alluded to above.

For the vast majority of platforms it simply makes little sense to become a true Payment Facilitator.

The question then becomes: “Why go down the true PayFac pathway?”

The Payment Facilitation As A Service model does have a downside. In the true PayFac model if “My Medical” was a client of the Health Care platform offering payment solutions, then a patient sees “My Medical” on their credit card statement. In the Payment Facilitation As A Service model if your Master PayFac is “YourPay” for example, the patient would see “YPY* My Medical” on their statement [descriptor] where YPY* indicates YourPay as the master or true PayFac.

This may not be an issue or it may depending on your business model. Another reason to act as the true PayFac is you own the payment process and that customer. There is no one in between or involved. Certain business may value that. Especially if you are positioning your application to be acquired. Even then the Payment Facilitation As A Service model may still offer better solution.

In the last few years, payment providers have realized there’s a sizeable market for Payment Facilitator like solutions without all of the expense and hassle.

Enter Payments as a Service

In the Payment As A Service model you are in essence a sub PayFac. So a true PayFac assumes all those compliance and regulatory and infrastructure costs.

A platform has been created for you to leverage these tools and act as a sub Payment Facilitator. They have a lot of insight into your clients and their processing. This level of insight mitigates much of the financial risk alluded to above.

So if adding payments quickly and easily with no risk, the ability to instantly onboard and generate new revenue streams sounds good, we are here to help.

| % Declines Recovered | Estimated Additional Revenue |

| 30% recovery | |

| 35% recovery | |

| 40% recovery | |

| 45% recovery | |

| 55% recovery |

Payments as a Service, or PaaS, enables platforms to quickly and easily offer payment solutions, eg ACH and credit card processing, primarily to drive revenue from payment processing fees as well as offering simple onboarding

The benefits are revenue generation, straight-forward payments integration and off-loading regulatory and compliance issues as well as mitigating payment risk

Payments as a Service is a best fit for SaaS platforms that are looking to add or expand payment solutions and in doing so create recurring revenue from payment-related fees but don’t want compliance/financial risk/ time-consuming integration and certification

Depending on your go to market pricing this will vary but if using a standard 2.9% and 30 cents per transaction you could see close to half a percent and 15 cents for every transaction processed

payment system, risk, infrastructure, payments as a service, cloud computing, regulatory compliance, outsourcing, software as a service, scalability, fintech, platform as a service, fraud, payment processor, customer, innovation, financial institution, accounts payable, ecosystem, ownership, currency, single euro payments area, analytics, cash, machine learning, risk management, bank account, core banking, revenue, tokenization, payment card industry data security standard, consumer, customer experience, server, complexity, business model, instant payment, data security, invoice, regulation, landscape, emerging technologies, demand, credit, iso 20022, wire transfer, fee, payment card, value chain, encryption, global payments, payment rails, paystand, payment processes, embedded payments, payments modernization, credit card processing, merchant services, square credit card reader, credit card processing companies, square credit card processing, square terminal, organization, automation, adyen, leverage, automated clearing house, adoption, efficiency, unified payments interface, onboarding, telecommunications, infrastructure as a service, banking as a service, transaction processing, retail, microservices, touchpoint, acceptance testing, customer service, governance, machine, electronic funds transfer, high availability, customer satisfaction, operating system, architecture, contract, digital currency, price, audit, capital expenditure, payment processing, remittance, operational efficiency, total cost of ownership, intelligence, cash flow, transparency, biometrics, braintree, leadership, foreign exchange market, digital economy, computing, interface, economies of scale, latin america, asset, interoperability, accounting, information security, faster payments, payment gateway, payment products, financial services companies, financial services, instant payments, blog post, software development, payment providers, financial institutions, paas, paas providers, payment services, financial services industry, payment systems, paas solutions, sct inst, payment infrastructure, payments hubs, payments services, banking solution, global payments report, sepa instant payments, sepa instant, digital payments, service providers, paypal credit card, ach payment, amazon pay, ach transfer, merchant account, payments as a service platform, point of sale, debit card, expense, payments platform, accept payments, bank accounts, online payment platform, payment platforms for small businesses, shopify payment processing, wix payments, payment processing platforms, squarespace credit card processing, squarespace payment processing, wix payment processing, best online payment platform, brand, workflow, data center, end user, communication, authentication, information security management, payment card industry, vendor, statistics, information technology, downtime, payment platforms, digital transformation, shopify installment payments, payment as a service, digital wallet, know your customer, accounting software, payment process, database, mobile app, option, understanding, commerce, apple pay, chargeback, moneygram online, pay pal