Disrupting the ACH and Credit Card settlement and funding process via a Funding Report

While there are some businesses that aren’t all that on top of their accounting, the vast majority of successful businesses have processes in place that rely on daily financial reconciliation.

Businesses that have a recurring payment customer base are especially dependent on reconciling deposits.

One of the challenges these businesses have is that most rely on a software platform that runs their entire business. Payment collection and reconciliation is often a major part of the software platform.

Historically the platform typically has partnered with a 3rd party payment provider and using an API, credit card and ACH payments are processed by the payments partner and the platform using reporting tools, again via the API to then update and reconcile the accounting side.

In the past, for the vast majority if not all of the current payment providers there has been an area where the actual bank deposits and the platforms financial reporting do not match. For example, the software reports you have received $50,000 while your bank deposits shows $43,500. As you would imagine this creates an enormous amount of work and angst for those tasked with the accounting and reconciling.

So what causes this? One issue is timing. Most, if not all, ACH payment processors rely on batch funding dates. That leaves merchants making inferences based on their normal funding schedule. Even with that, there may be discrepancies, as not all transactions in the batch may be settled in the same timeframe. The batch report may also not take into account any returns, chargebacks, etc.

You may also have funding delays from the bank or ODFI that the payment processing partner relies on to distribute payouts. The ACH world further complicates reconciliation in that there is now way to know at the time of processing that the customer has the requisite funds in their account (or if the account and routing number are valid).

The reconciliation issues are fundamentally caused by relying on “best guess” for funding by your payment partner. In most cases this “best guess” is correct and all your numbers match.

The problem is that when mismatches occur they lead to increased workload and frustration for your platform users.

While both ACH API providers and credit card API’s have advanced and offer REStful architecture that enables deeper insight into payment and exception reporting, the actual deposits have not been able to be tied back to the financial accounting package. That is, until now.

Our enhanced ACH and Credit Card API offers SaaS platforms the ability to reconcile based on the actual bank deposit.

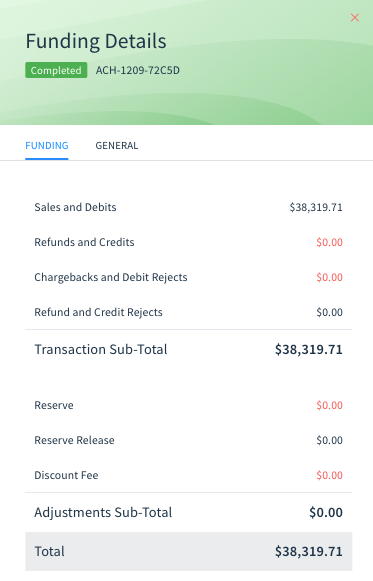

The Funding Object (report)

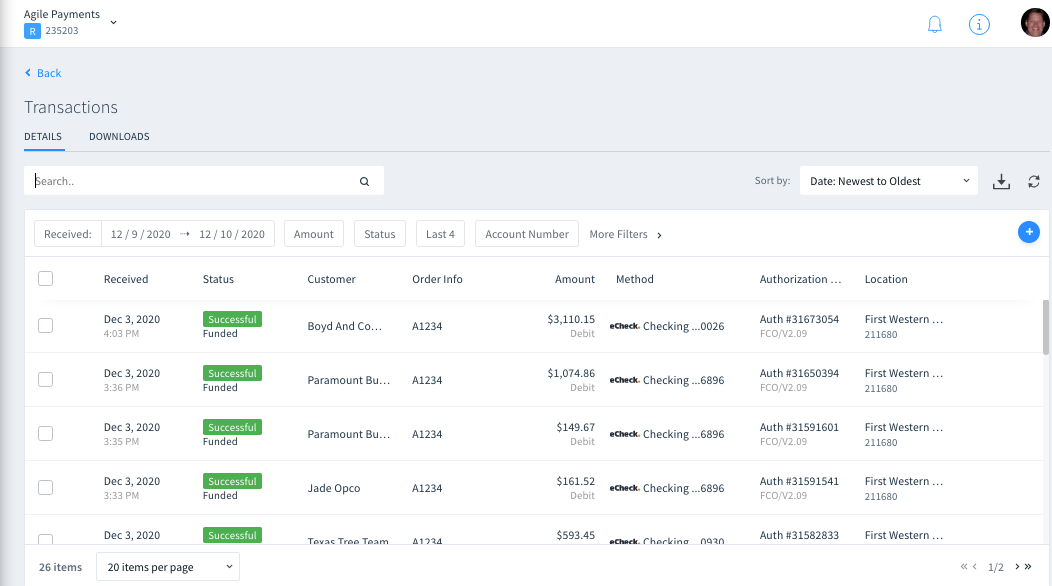

A funding report can reliably tell a merchant the date that funds posted to their bank account and show each transaction that makes up the funding (be it sale, refund, return, chargeback). A unique descriptor is assigned to their bank statement that can be used in an online portal or via API to search for the funding (reverse lookup).

That means your clients accounting and reconciliation becomes much simpler and you don’t get phone calls asking why their reports don’t match what they see in their account. Very nice.

Think about a client of yours using the new reconciliation system. They have experienced the frustration and work it took to wrangle their reconciliation. Ask yourself-what are the chances they would want to leave your platform for one that can’t offer deposit reconciliation?

Proper Deposit Reconciliation creates a competitive moat around your payment processing solution.

By making your product more useful and valuable to end clients you maximize retention rates, reduce support burdens and generate more referral business.

If you are looking to create a new payment experience for your customer base contact AgilePayments today.