A 2025 Guide

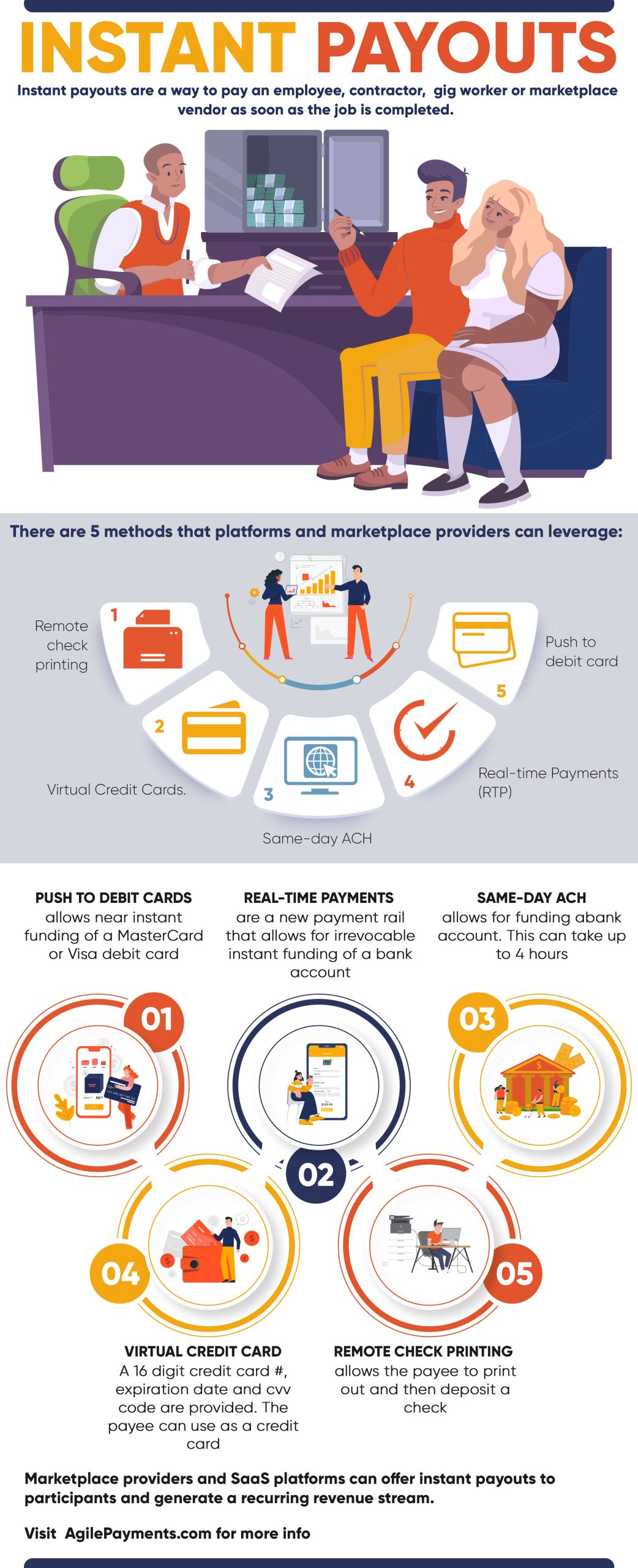

Instant payouts are a way to pay an employee, contractor, gig worker or marketplace vendor as soon as the job is completed. Instead of having to go through the often laborious and time-consuming accounts payable process (and make the payee wait for their payment), you can make immediate, hassle-free disbursements using recipients preferred payment methods, including bank transfers, push-to-debit-card, virtual credit card and remote printing of a paper check.

For SaaS platforms and MarketPlace providers looking to embed an Instant Payout solution as part of their product offering it is important to understand the various payout options, how “instant” they are and very importantly how Instant payouts can be used to both attract new platform clients and generate a new payments driven recurring revenue stream.

If your business is currently using Managed Payment Facilitation your PayFac partner should already have or be working on Instant Payouts. It can be difficult to bolt-on Instant Payouts solution to an existing PayFac as a Service solution due to money transmission compliance. Essentially your platform can’t take possession of $ that are due your marketplace participants.

In a business climate where workers, sellers and contracts aren’t always local, getting to grips with the best way to make payouts isn’t easy. For businesses working in the gig economy and marketplaces, understanding and offering instant payouts is critical for success if you’re looking to build loyalty with contractors and gig workers. That’s especially true for those competing for talent in new and existing markets. The ability to offer instant payouts can be the make-or-break factor in your success.

Both MasterCard and Visa offer push to card payments. For all of our payout examples we will use the example of a home service platform that connects independent contractors with homeowners. The platform sources the customer and takes payment for the completed job. The platform could say to their independent contractor “You can be paid in 2-4 days, or we can move money now to your debit card”. There is a cost to the platform to do this. As an example we will use $1.00. The platform could say “you can receive your $ within 15 minutes for an added fee”. That fee could be $2 or like QuickBooks, 1%. On a $1000 job the platform could see $9 in revenue.

You may be thinking, how does the money flow? Essentially in all of our Instant Payout schemes payout risk must be mitigated. Typically if the platform want to push out $1000 or $991 in our example, they will pre-fund an escrow-like account with their payments partner. This covers the risk exposure of the payment processor pushing money out and not being to collect from the platform. There are are other risk mitigation measures that we will address in the risk section.

Real-time payments (RTP) are payments that are initiated and settled nearly instantaneously. A real-time payments rail is the digital infrastructure that facilitates real-time payments. Ideally, real-time payment networks provide 24x7x365 access, which means they are always online to process transfers. This includes weekends and holidays.

In the United States, the most prominent example of a real-time payments network is The Clearing House’s RTP network. FedNow, the Federal Reserve’s anticipated real-time solution, will also fall under the definition of a real-time network. The Federal Reserve is projecting to launch FedNow in 2023.

There are a number of different payment “rails”. We have ACH, credit card and now real-time payments.

The advantage of real-time payments are that they are super fast and funds are know to be good and the transaction is final. In addition rich data can be passed and captured for sophisticated reconciliation.

The downside? Not all banks participate in the RTP network. Here is a list of participating banks.

Depending on geography the coverage rates can vary. Estimates range in the 60% range.

What happens when you try and use the RTP and one of the banks is not in network? Typically, the fall back is same-day ACH.

ACH payments typically take 2-4 days to settle. Same-day ACH uses the ACH rail, but the bank involved in the transaction must comply with funding the receiving bank account. The caveat is that the origination of all Same Day ACH files, transactions and batches must be received by 11 a.m. CT to process as a Same Day. The receiver’s bank posts credits to their customers bank multiple times per day. Again your payments partner will likely force the platform to pre-fund and escrow account.

With a Virtual Credit Card (VCC), the payee is sent a 16 digit credit card#,expiration date and cvv code.

That card can then be used like a physical card. The receiver could in turn fund an ewallet, use on Amazon etc.

In this case the payee is emailed an electronic check. They can then print and deposit this check at their bank or remotely.

There is also the option to physically print and mail a check and of course standard ACH transactions.

On-demand access to money for recipients –earnings can be sent to an eligible card within minutes.

24/7 availability–and this includes weekends and holidays.

Increased loyalty –whether it’s a 1099 contractor, gig worker, or marketplace seller, the fact they know they’ll get instant payments will boost loyalty and adoption of your platform. Ride share company Lyft started offering instant payouts in 2015, and by 2018, 58% of its drivers had opted to receive their payouts that way.

Increased productivity –the thought of receiving payment as soon as the job is completed is definitely a great motivator!

Instant funds from sales -As well as being advantageous for workers or sellers, Merchants can benefit from instant payouts. When you make a sale, the money can be sent immediately to a connected account debit card, bank account or digital wallet, simplifying accounts payable.

Using Instant Payouts to Capture Market Share

There are many industries where offering instant payouts was proven to increase platform participate. Uber, Grab, DoorDash are justa few that saw dramatic improvements. Grab was able to dominate the ride sharing market partly by paying drivers in real-time, while competitors paid every few days.

Let’s consider a case where a Home Services company connects customers with professionals such as plumbers, electricians, and locksmiths.

Instant Payouts as a Recurring Revenue Driver

QuickBooks charges 1%, Square? 1.5%.

Starting to get the picture? There is SIGNIFICANT revenue potential.

The vast majority of the time your platform or business will need to pre-fund an escrow-like bank account that you Instant Payment solution partner has access to.

If you were asked to send your money to another entity and you were relying on being paid back those funds you can see how that could make you nervous. What if you were not able to get those funds you had irrevocably paid out? It happens and when it does it creates financial loss. This is why pre-funding is the preferred method of risk mitigation.

There are other potential solutions eg using a letter of credit. A public or very strong company may be offered additional options.

This means you need to comfortable and capable of pre-funding an account for your disbursements needs.

Whether you are a SaaS platform automating commission payouts or a Marketplace Payment Solution paying participants, InstantPayouts make your product or service nore attractive to the participants. The vast majority of people in the gig economy or independent artists want faster funds access.

You can give it to them, making for happier, stickier clients while at the same time adding a potentially lucrative recurring revenue stream.

Contact us to see how you can use elegant, simple API’s to add an Instant Payout option to your platform.

Instant Payout Solutions allow a business individual to receive funds in one of the following ways

One of the largest Instant Payout Solution in use is for

These can vary but a small % is possible. Flat rates are typical in the $1-$1.50 range

bank account, currency, know your customer, cash, customer, revenue, fraud, regulatory compliance, customer experience, payment system, accounts payable, wire transfer, automation, risk, expense, single euro payments area, infrastructure, latin america, fee, efficiency, credit, brand, tokenization, analytics, omnichannel, convenience, accounting, business model, digital wallet, regulation, scalability, cash flow, personalization, latin, operational efficiency, user experience, onboarding, confidence, supply chain, customer support, retail, ecosystem, mobile app, consumer, online marketplace, gig economy, local currency, faster payments, payout solutions, local payment methods, funds, payout methods, digital payouts, service providers, payment methods, alternative payment methods, customer satisfaction, encryption, end user, vendor, price, debit card, payroll, instant payouts, employees, instant payout, invoice, turnover, inventory, stripe dashboard, ach, instant pay, bank connections, enable, online payments, instant payment, authentication, competitive advantage, paid