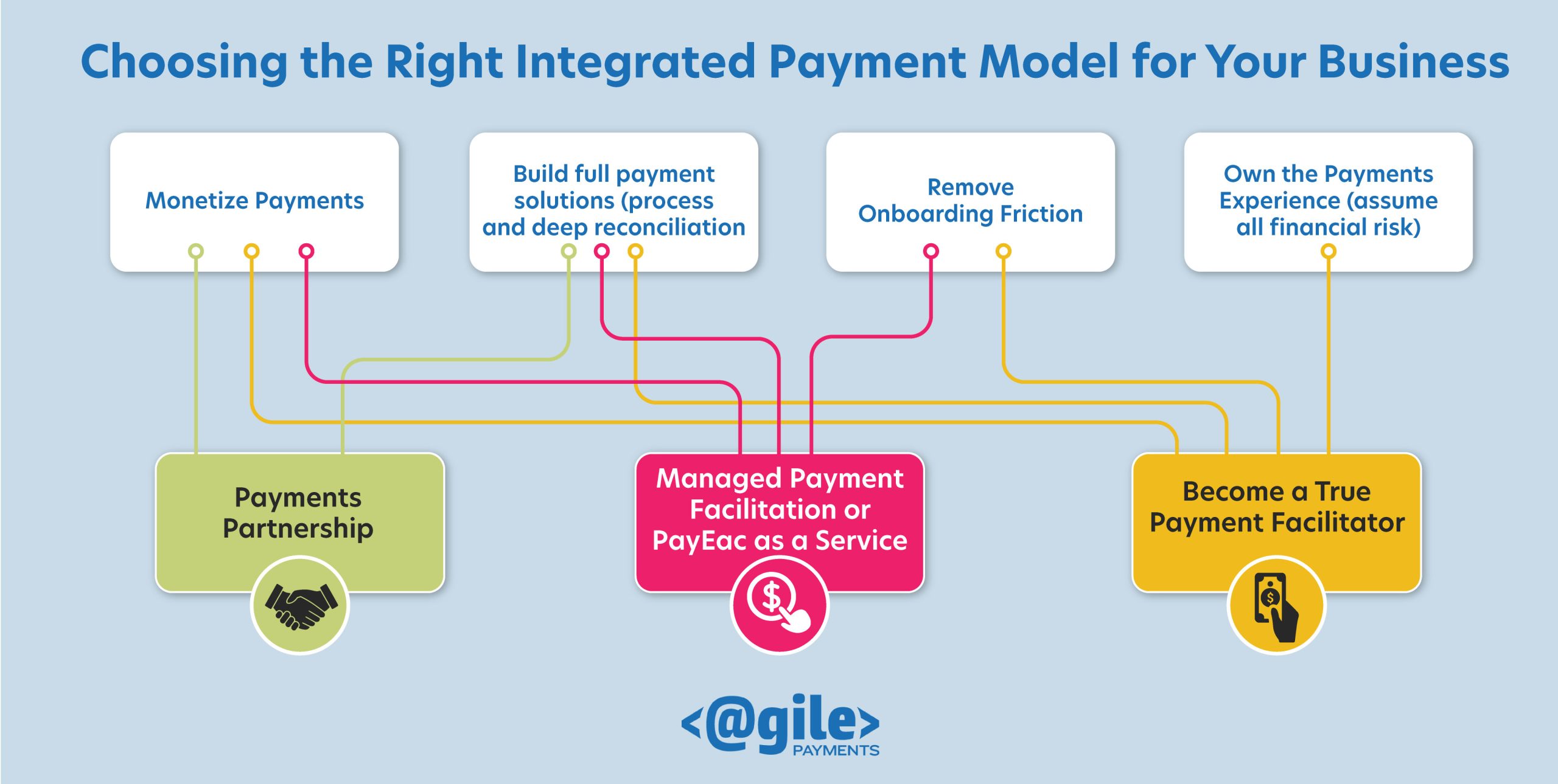

Choosing the Right Integrated Payment Model for Your Platform

When deciding on the most suitable integrated payment model for your business, several factors come into play, including your available resources, desired business outcomes, and preferred launch timeframe. Here are some key questions to consider to help guide you through the decision-making process

When deciding on the most suitable integrated payment model for your business, several factors come into play, including your available resources, desired business outcomes, and preferred launch timeframe. Here are some key questions to consider to help guide you through the decision-making process

How much overhead are you willing and able to invest? Consider your capacity in terms of both time and capital to develop custom payment features or even a complete payment tech stack. If resources are limited, traditional referral partnerships or becoming an ISO may be the more practical options.

Alternatively, if you have slightly more resources but still want to keep costs manageable, partnering with a Managed PayFac can be an excellent choice.

Are you looking for a quick ROI or long-term gains? Payment partnerships and PayFac collaborations will allow you to monetize payments more rapidly. The Payments Partnership can offer instant onboarding if the vertical being served is low risk.

Conversely, becoming a full-blown PayFac might require a longer timeframe to see a return on investment. What business drivers are most important to you? Identify your main goals for integrating payments. If innovative and embedded payment functionality is a top priority, sticking with the PayFac model – either by operating as a full PayFac or partnering with a managed PayFac – would be advantageous.

What are your in-house development resources? Opting for a Payments Partnership minimizes the need for in-house development, and the same applies to partnering with a managed PayFac. However, building a full PayFac infrastructure necessitates having a complete development team on staff.

How much responsibility are you willing to take on for underwriting merchant accounts? As a true PayFac, you’ll be closely involved in onboarding accounts, which means assuming risk. On the other hand, a Payments partnership or leveraging the Managed PayFac or PayFac as a Service collaboration minimizes financial risk.

Start Monetizing With Agile Payments

Agile Payments offers a managed PayFac solution that allows software companies to integrate powerful payment processing features and take advantage of generous revenue-sharing opportunities. With low-code integration options, you can quickly implement embedded payment functionality, provide a robust end-user experience, and generate profitable revenue.

Moreover, once your processing volume reaches a significant level (e.g., $50 million annually+ in volume), we can assist you in transitioning to the full PayFac model, further enhancing your revenue potential and business valuation!

Need guidance on the best option for your business? Set up a quick, no-commitment chat with a member of our team by clicking here! We take pride in helping software leaders like you navigate the payments landscape. Contact us today!