Businesses can significantly reduce payment acceptance risk with electronic check verification tools by performing real-time validation of a customer’s bank account, ensuring that the account is active with a positive funds status. **Important Mandated Checking Account Validation Changes: Detailed info here

Beginning March 2021, NACHA will implement a new rule that mandates enhanced checking account verification measures.

Businesses that debit payments via ACH for online or web based orders are required to implement enhanced fraud detection to comply with the new NACHA web debit account validation mandate.

Specifically, the organization will require such businesses to include, at a minimum, Checking Account Validation as part of a “commercially reasonable fraudulent transaction detection system.”

ACH Check Verification allows merchants to mitigate check acceptance risk at the point of sale, online or in person. By validating checking accounts before client onboarding businesses can reduce failed or rejected customer payments. Checking account verification options range from automated routing number check to negative database options to near real-time inquiries into current checking account status, and checking account balance inquiries (which require the customer to either log-in or provide credentials to their online banking system). Immediate checking account verification tools are especially effective at mitigating the risk of using bad data when setting up recurring payment plans. Beginning in March 2021, NACHA will implement a new rule that mandates enhanced checking account validation and verification measures. Businesses that debit payments via ACH for online or web-based orders are required to implement enhanced fraud detection to comply with the new NACHA web debit account validation mandate Specifically, the organization will require such businesses to include, at a minimum, Checking Account Validation as part of a “commercially reasonable fraudulent transaction detection system.” The change enhances NACHA’s anti-fraud attempts. Simply stated, the new NACHA checking account validation rule means checking to make sure that the checking account routing and account numbers submitted for a given ACH transaction are valid. By valid we mean the account is open. Traditionally businesses rely on the consumer to input account information. For many reasons including bad data entry these transactions would get rejected when the customer’s bank received the debit instructions. AgilePayments offers easy to implement, NACHA compliant solutions for this new mandate. Contact us to discuss how we can help with checking account validation needs.

What are the risks associated with onboarding new customers? Client onboarding is often a major friction point for businesses, especially those that rely on future recurring payments So, what does this mean for your business? Problems such as payment rejects or mis-entered customer data are usually only uncovered after payment is accepted, sometimes as long as days later. This means that businesses absolutely must know whether or not a bank account is valid. A Check Verification Service allows a business to validate that an account is open and in good standing prior to the account being loaded into a recurring billing engine. This means that data entry, potentially closed accounts, or even fraud can be caught before “booking” the sale. The ability to potentially save a sale directly translates into a revenue uptick, as a subset of these clients will never be recovered. Checking Account Verification Services also allow merchants to mitigate check acceptance risk at the point of sale, with account verification options ranging from negative database inquiries and automated routing number checks, to near real-time inquiries into current checking account status [eg open/closed].

Unlike credit cards, the ACH realm lacks an authorization component. Credit cards allow for authorization at the time of payment,ensuring that a customer has the requisite funds on their cards, and reserving those funds for capture and settlement. For some businesses this lack of an authorization means that (3)ACH Check Verification is necessary to mitigate payment acceptance risk, and prevent your newly onboarded customer from needing to perform a significant amount of work to obtain correct or valid checking account information.

The customer may provide their bank account and routing info or a voided check might be taken. In either case there is the potential for user error when inputting data. Instant Check Verification offers the chance to validate the account is open and in good standing before the account will be loaded into a recurring billing engine. So a data entry or possibly closed account or even fraud can be caught before “booking” the sale. Consider an insurance company binding a policy on Monday the 1st. Conventionally the insurance company might not now for a week or more that policy should be never have been written. What happens if in that week a claim is made? For a small transaction fee they could have avoided a $30,000 loss. Or the energy company that essentially may be providing a free month of service to a renter or homeowner that knows how to game the system. Many businesses use third parties to generate new customers. Typically these 3rd parties are paid when the new client is boarded. In many cases the same or next day. What happens when that new customer’s payment fails because of bad checking account data? Again more friction, more financial loss and more potential for losing that new customer. By employing a checking account verification system businesses can eliminate much of the “after the sale” work needed when payment fail. In addition you can often save a sale. The majority of the time payment rejects are accidents. If the customer has to go through the hassle of the sale process again there is no doubt there will be a subset of those sales that will be lost. By leveraging checking account verification tools businesses don’t lose hard won customers because of data entry errors.

Payment rejects are typically discovered only after payment is accepted, sometimes days later. A system to check that a bank account is valid can be invaluable for businesses that operate with a recurring payment model. When payment rejection occurs the business has multiple issues to address:

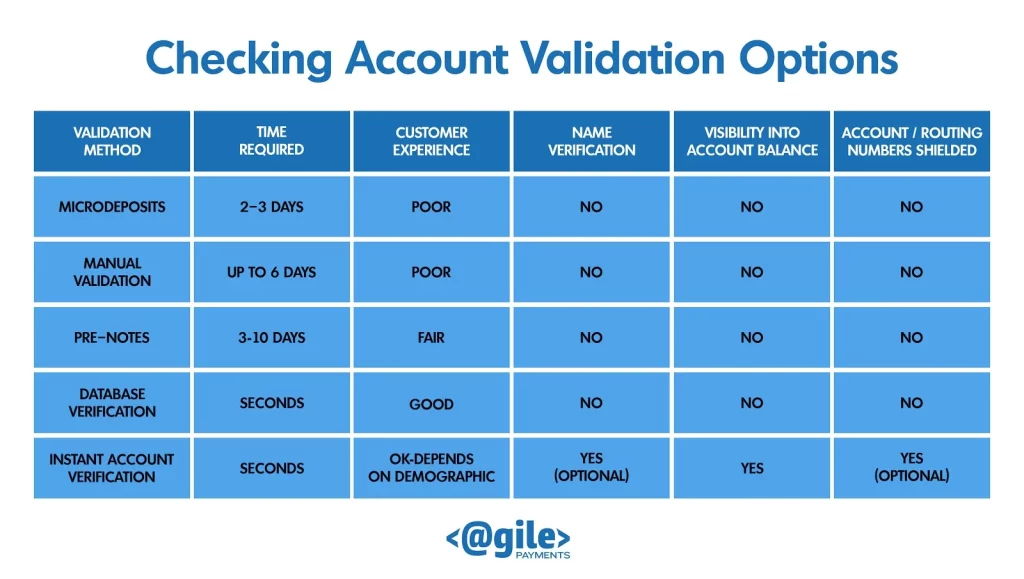

For businesses that accept checks either as an ACH, Check 21 or Remote Deposit all face the risk that the payment will result in a return [failed transaction]. Mitigating loss through third party check verification services can be an important part of the business that relies on ACH processing for check acceptance. So how does a business reduce check acceptance risk? ACH Check Verification Services Bank routing numbers identify the bank that a check is drawn against, and the databases holding this information can be checked in real time. Negative databases (comprised of the positive/negative history of that checking accounts info) exist a means of protection for businesses. For example, Walmart can report on whether a check is good or bad to the database. A plethora of retailers contribute data to the network, meaning there are millions of checking accounts to reference. Recency is an issue because a customer’s last instance of writing a check at a participating retailer becomes the last data point. The chart below illustrates check verification options:

The ATM network provides check verification options. A daily upload of account status is made to the network by banks and credit unions, and queries to the network can provide account insight. When a check verification inquiry comes in an almost immediate response can be tell you:

Depending on the provider, the information can indicate:

An ideal 3rd party provider will provide a combination of all the services discussed including:

The checking account verification services at this level do NOT provide funds availability or balance inquiry, or bank account ownership. For many businesses this provides a significant improvement in their payment acceptance processes. You can get additional information regarding account owner, balances and even asset and transaction history. To leverage this functionality the customer/applicant would be presented a lightbox that would allow them to select their bank and then be prompted to log-in. Once in you would be able to access information via API. This level of account details as you would expect is significantly more expensive than standard check verification. New client intake or onboarding can be a major friction point for businesses that rely on future recurring payments. By employing ACH Check Verification businesses can eliminate much of the “after the sale” work needed when payment fail.

Let us know about your verification needs.

Case Study #1: A major insurance company providing auto and home coverage was experiencing new policy onboarding problems. Both phone based sign-ups and web based customers were being issued insurance coverage upon providing the requisite information. Part of this information was checking account and routing number. Billing information would be used for debiting premium payments primarily on a monthly basis. When debiting the checking accounts for premium payments it was apparent that there were two problem areas: 1-Data entry errors: Either from the insurance rep or if signing up online mistakes were made when keying in information 2-Although the account and routing numbers entered corresponded to a valid bank account, the debit to that account rejected. Reasons for rejects vary-see chart below.

| Code Description | Detail |

| R01 Insufficient Funds | Available balance is not sufficient to cover the amount of the debit entry |

| R02 Account Closed | Previously active account has been closed by the customer of RDFI |

| R03 Unable to locate account | Account number does not correspond to the individual identified in the entry, or the account number designated is not an open account |

| R04 Invalid bank account number | Account number structure is not valid |

| R06 Returned per ODFI request | ODFI requested the RDFI to return the entry |

| R07 Authorization revoked by customer | Receiver has revoked authorization |

| R08 Payment stopped | Receiver of a recurring debit has stopped payment of an entry |

| R09 Uncollected funds | Collected funds are not sufficient for payment of the debit entry |

| R10 Customer advises not authorized | Receiver has advised RDFI that originator is not authorized to debit his bank account |

Finding out after the policy has been issued that the applicant can’t be billed is a BIG problem. First there is the issue of dealing with nullifying coverage. Outreach must be done to contact that customer and try to secure correct bank info. In some cases there is intentional fraud being committed to secure an insurance card e.g., for automobile coverage. In most cases this is is an error that can be remedied. The issue is the time and energy and money the insurance company spends doing this. The solution: Implementing a Checking Account Verification solution Through check verification online via API, the insurance company has been able to significantly reduce onboarding error. Either via web or phone data entry errors are caught in real-time. This in some cases saves a sale. The consumer or rep can validate information provided corresponds to a valid checking account with a positive funds status. The checking account verification system catches both data entry errors and can flag accounts that would reject if an ACH debit was immediately made. Significant man hours are saved as well as potential risk mitigated by employing a Checking Account Verification system.

Payment rejects are usually accidents. Making a customer go through the hassle of the sale process again will ensure that a subset of those sales will be lost. By leveraging checking account verification tools businesses don’t lose hard won customers because of data entry errors. By the same token, businesses that rely on future billing are especially vulnerable to bad check data. However, using a cutting edge ACH Check Verification businesses can dramatically reduce bad check acceptance and the subsequent problems. The check verification service should be available as a stand alone [eg using a web based Virtual Terminal] or in integrated fashion that can be programmatically part of workflow. Approve/Decline logic can be customized to the particular business. In some use cases for instance an account currently in an NSF stats may still be onboarded.

For validating account and routing number per transaction fees begin at 35 cents with volume discounts. For Checking account ownership fees depend on volume and levels of info required but typically begins at $1.00 per transaction. Again, depending on use case company revenue requirements may be in play.